The $280 Shift in Home Affordability Every Buyer Should Know!

If you hit pause on your home search because of high interest rates or prices, it might be time to take another look — affordability is improving in 39 of the top 50 U.S. housing markets, according to First American!

The average monthly mortgage payment is now $283 lower than it was just a few months ago (per Redfin). That’s nearly $3,400 in annual savings!

A buyer with a $3,000/month budget can now afford a $468,000 home — about $22,000 more than in June. That’s real buying power that could open up new possibilities and price points.

As Andy Walden of ICE Mortgage Technology notes, “Affordability is at a 2.5-year high.”

Whether you’re a first-time buyer or ready to move up into your next home, this shift could make your move possible.

Let’s run the numbers and see what your buying power looks like today!

Categories

Recent Posts

Why Do Realtors Host Open Houses?

Home Warranty vs. Home Insurance: What You Really Need to Know

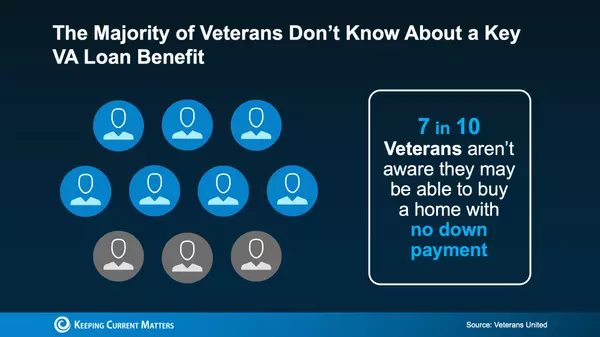

Veterans: Don’t Miss Out on Your VA Home Loan Benefits!

Keep Your Home Sale on Track: Avoid These Common Deal Breakers

Today’s Real Estate Market Looks Different — Here’s How Sellers Can Win

First-Time Buyers Down. Cash Buyers Up. The Market Is Shifting.

Thinking of waiting until spring to sell? Think again!

Solar Panels – A Cautionary Tale from the Central Texas Market

What a Fed Rate Cut Could Mean for Mortgage Rates

Thinking About Buying a Home? Start Here FIRST!