What a Fed Rate Cut Could Mean for Mortgage Rates

Right now, all eyes are on the Federal Reserve. Economists widely expect a few rate cuts before the end of 2025, but here’s what you need to know if you’re watching the housing market

Categories

Recent Posts

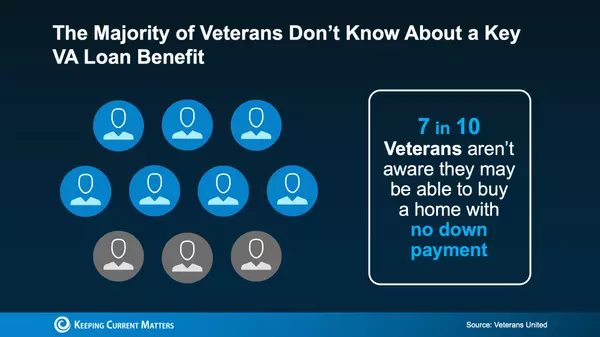

Veterans: Don’t Miss Out on Your VA Home Loan Benefits!

Keep Your Home Sale on Track: Avoid These Common Deal Breakers

Today’s Real Estate Market Looks Different — Here’s How Sellers Can Win

First-Time Buyers Down. Cash Buyers Up. The Market Is Shifting.

Thinking of waiting until spring to sell? Think again!

Solar Panels – A Cautionary Tale from the Central Texas Market

What a Fed Rate Cut Could Mean for Mortgage Rates

Thinking About Buying a Home? Start Here FIRST!

Thinking of selling your home in Central Texas?

What Are Seller Concessions & How Can They Help You Sell Your Home Faster?