Applying for a Mortgage? Here’s What NOT to Do After You Apply!

Once your lender reviews your finances, consistency is key. Here are  major things to avoid during the home loan process:

major things to avoid during the home loan process:

Switching banks can raise red flags and delay your approval.

New credit or changes to existing accounts can impact your credit score.

Unverified deposits = underwriting headaches. Keep it clean and traceable.

Even if it’s to help someone out, it affects your debt-to-income ratio.

That new couch, car, or fridge can wait! Large expenses can hurt your loan approval.

Let’s keep your path to homeownership as smooth as possible

Need expert guidance? DM me anytime

Categories

Recent Posts

Why Do Realtors Host Open Houses?

Home Warranty vs. Home Insurance: What You Really Need to Know

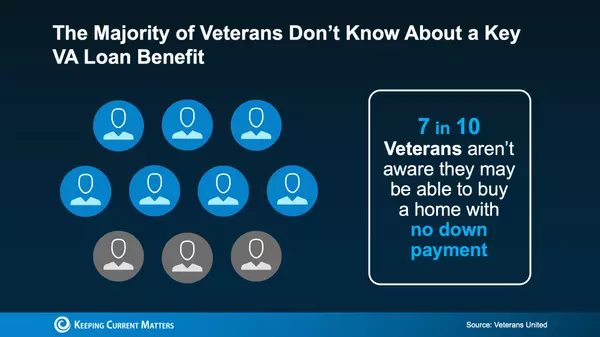

Veterans: Don’t Miss Out on Your VA Home Loan Benefits!

Keep Your Home Sale on Track: Avoid These Common Deal Breakers

Today’s Real Estate Market Looks Different — Here’s How Sellers Can Win

First-Time Buyers Down. Cash Buyers Up. The Market Is Shifting.

Thinking of waiting until spring to sell? Think again!

Solar Panels – A Cautionary Tale from the Central Texas Market

What a Fed Rate Cut Could Mean for Mortgage Rates

Thinking About Buying a Home? Start Here FIRST!