Thinking About an Adjustable-Rate Mortgage (ARM)? Read This First!

House hunting in today’s market?  With high mortgage rates and rising home prices, many smart buyers are considering Adjustable-Rate Mortgages (ARMs) to keep their monthly payments manageable.

With high mortgage rates and rising home prices, many smart buyers are considering Adjustable-Rate Mortgages (ARMs) to keep their monthly payments manageable.

But if you're thinking “Didn’t ARMs cause problems in 2008?”  — don’t worry. Today’s ARMs are different.

— don’t worry. Today’s ARMs are different.  Lenders now verify that you can still afford the loan even after the rate adjusts.

Lenders now verify that you can still afford the loan even after the rate adjusts.

BUT… it’s not all upside.  If interest rates go up, so can your payment later.

If interest rates go up, so can your payment later.

And don’t forget — even with a fixed-rate mortgage, your monthly cost can rise due to property taxes or homeowner’s insurance increases.

Categories

Recent Posts

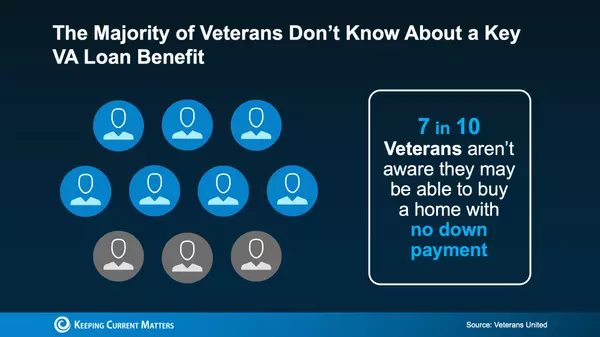

Veterans: Don’t Miss Out on Your VA Home Loan Benefits!

Keep Your Home Sale on Track: Avoid These Common Deal Breakers

Today’s Real Estate Market Looks Different — Here’s How Sellers Can Win

First-Time Buyers Down. Cash Buyers Up. The Market Is Shifting.

Thinking of waiting until spring to sell? Think again!

Solar Panels – A Cautionary Tale from the Central Texas Market

What a Fed Rate Cut Could Mean for Mortgage Rates

Thinking About Buying a Home? Start Here FIRST!

Thinking of selling your home in Central Texas?

What Are Seller Concessions & How Can They Help You Sell Your Home Faster?